Tax Resources

Locations:

01 Three Creeks Library

02 Mill Plain

03 Clark County Food Bank

Reference

VITA/TCE Volunteer Resource Guide (Pub 4012)

a guide to assist VITA Volunteers in preparing a return using the provided software

Your Federal Income Tax (Pub 17)

“covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instructions.”

What’s New starts on page 2

line by line instructions

current revision; recent developments; related items; other items

Internal Revenue Code Title 26 > Subtitle A - Income Tax

Interactive Tax Assistant (ITA)

“provides answers to several tax law questions specific to your individual circumstances.”

filing requirements; filing status; dependents; income; deductions; credits; etc.

Privacy, Confidentiality, and Civil Rights - A Public Trust (Pub 4299)

“addresses areas where partners and volunteers need to exhibit diligence to details when administering the requirements of these programs.”

Glossary of Tax Words and Phrases in various languages.

Time you can claim a credit or refund

The oldest year clients can receive a refund for is 2022.

Had to be filed on 2020 and 2021 returns. Refunds are no longer being issues for those years so clients can no longer receive stimulus payments they did not previously receive.

Tools

-

See the What’s New section for:

Tax law changes

Changes taking effect in 2025

Other changes

-

Federal: Refunds > Where's My Refund > Check My Refund Status

Washington WFTC: Check the status of your refund

Oregon: Revenue Online

In the Individuals section select Where’s My Refund?

-

General internet searches for EINs may not result in a correct EIN.

Check with Site Coordinator

For publicly traded companies search the SEC’s EDGAR

Search by Company…

Expand Company Information

EIN is listed in the first column.

Or:

Selected Filings

Select the 8-K or 11-K

In header on the right is IRS Employer Identification No.

If you don’t see it, search by using Crtl + F

Nonprofit organizations

Use the IRS’s Tax Exempt Organization Search

Search by name

Search result will include the EIN

-

-

Accreditation: Postsecondary Education Institutions

Education Credits: "eligible to participate in a student aid program administered by the U.S. Department of Education"

-

Real Estate Tax Paid

Clark County, WA Property Information Center

search for street address

select Taxes tab > scroll down to Tax history or select the Tax Statements button

Contributions to Charities

check an organization's eligibility to receive tax-deductible charitable contributions

-

See the Working Families Tax Credit section for:

Website

Eligibility

FAQs

Prior years refund amounts, etc.

Resources

-

See the Oregon section for:

Department of Revenue website

OR forms and publications

Where’s My Refund?

What’s My Kicker

-

Oregon VITA & Taxaide - Volunteer Tax Preparers

Tools, References, etc.

tools are designed to be helpful to AARP Tax-Aide Counselors

What’s New in Tax Season 2026

Tax Law Changes

Tax Act of 2025

Public Law 119-21 (congress.gov)

IRS Tax Act of 2025 provisions (irs.gov)

Journal of Accountancy: Tax provisions in the Tax Act of 2025

Changes taking effect later

-

For purposes of losses from wagering transactions, the amount allowed as a deduction for any taxable year-

(A) shall be equal to 90 percent of the amount of such losses during such taxable year, and

(B) shall be allowed only to the extent of the gains from such transactions during such taxable year.

Effective: taxable years beginning after December 31, 2025.

Sources:

2025 Law: Sec. 70114 …Limitation on wagering losses

-

Deduction for cash contributions up to $1,000 ($2,000 for MFJ).

Effective: taxable years beginning after December 31, 2025.

Sources:

2025 Law: Sec.70424 …Deduction for charitable contributions of individuals who do not elect to itemize

IRC: Sec 170(p) Special rule for taxpayers who do not elect to itemize deductions

Changes taking effect in 2025

-

Should be on W-2 in box 7.

may deduct qualified tips received in occupations listed by the IRS as customarily and regularly receiving tips on or before December 31, 2024, and that are reported

Maximum annual deduction is $25,000; for self-employed, deduction may not exceed individual’s net income

To be eligible, you and/or your spouse who received the tips must have a valid social security number (SSN).

Occupations That Customarily and Regularly Received Tips on or Before December 31, 2024 (Department of Treasury)

Temporary: tax years 2025 through 2028

Sources:

-

may deduct the pay that exceeds their regular rate of pay and reported.

May be reported on W-2 in box 14.

To be eligible, you and/or your spouse who received the overtime must have a valid SSN.

Maximum annual deduction is $12,500 ($25,000 for joint filers).

Temporary: tax years 2025 through 2028

Sources:

-

Individuals who are age 65 and older may claim an additional deduction of $6,000 (or $12,000 total for a married couple where both spouses qualify).

Social security number required

Temporary: tax years 2025 through 2028

Sources:

-

Adjustment to income for a new vehicle (used vehicles do not qualify) purchased after 12/31/2024 for personal use and secured by a lien and with final assembly in the United States.

Deduction is available for both itemizing and non-itemizing taxpayers.

May have form 1098-VLI Vehicle Loan Interest Statement

Must include the vehicle identification number (VIN)

Use VIN to look up final assembly location

See the bottom of the report for Plant Information

Maximum annual deduction is $10,000.

Temporary: tax years 2025 through 2028

Sources:

IRS: News Release Issue IR-2025-129 guidance on the new deduction for car loan interest

These are new regulations that have not been published yet.

2025 Law: Sec. 70203 No Tax on Car Loan Interest

-

Limit for state and local taxes raised from $10,000 to $40,000. Adjusted each year through 2029.

Temporary: tax years 2025 through 2029

2030, goes back to $10,000

Sources:

-

Nonrefundable: $2,200 per child.

Refundable: $1,400.

Requires SSN for at least one spouse and the child.

Will be adjusted each year for inflation.

Sources:

Other Changes

-

New code Y added for Box 7 to identify a qualified charitable distribution.

Sources:

IRS Publication 4491, VITA/TCE Training Guide > Important Changes for 2025 > page ix

-

Includes deductions for following new tax provisions:

No Tax on Tips

No Tax on Overtime

No Tax on Car Loan Interest

Enhanced Deduction for Seniors

Sources:

Form: https://www.irs.gov/pub/irs-pdf/f1040s1a.pdf

IRS Publication 4491, VITA/TCE Training Guide > Important Changes for 2025 > page ix

-

For 2025, the following rates are in effect:

70 cents per mile for business miles driven

21 cents per mile driven for medical or moving purposes

14 cents per mile driven in service of charitable organizations

Sources:

IRS Publication 4491, VITA/TCE Training Guide > Important Changes for 2025 > page xi

-

For 2025, the maximum credit increased to:

$8,046 with three or more children

$7,152 with two children

$4,328 with one child

$649 with no children

Earned Income and AGI Amounts Increased

To be eligible for a full or partial credit, the taxpayer must have earned income and AGI of at least $1 but less than:

$61,555 ($68,675 if Married Filing Jointly) with three or more qualifying children

$57,310 ($64,430 if Married Filing Jointly) with two qualifying children

$50,434 ($57,554 if Married Filing Jointly) with one qualifying child

$19,104 ($26,214 if Married Filing Jointly) with no qualifying child

Sources:

IRS Publication 4491, VITA/TCE Training Guide > Important Changes for 2025 > page xi-xii

-

“phase out of paper tax refund checks beginning Sept. 30, 2025”.

In TaxSlayer, if select Paper Check following notice appears: “This return requests a refund but no direct deposit information is provided. The IRS will issue a Notice CP53E and you can expect a delay in the processing of the refund by up to an additional six weeks.”

Tips on Electronic Payment Options Available to Taxpayers as the IRS Phases Out Paper Checks (Taxpayer Advocate Service)

Options:

Direct deposit

Open bank/credit union account:

Certain mobile apps and prepaid debit cards.

If they have a routing and account number.

Can I get a checking account without a Social Security number or driver’s license? (CFPB)

Paying with a check will be phased out as well. “ For now, checks and money orders will still be accepted”

Source:

IRS Website

Forms, Instructions and Publications Search

browse or search all forms and publications

Forms, Instructions and Publications - Current

browse or search all current forms and publications

includes revision date

lists publications with links to HTML and PDF versions

eBooks are also available in the epub format

Quality and Tax Alerts for IRS Volunteer Programs

“Each Alert highlights issues to watch for when preparing tax returns during the filing season at volunteer tax assistance sites. Alerts will be posted as they become available. Check back for updates.”

guide designed to help people understand how tax changes affect them yearly and how to file an accurate tax return.

enter zip code for Vancouver and Portland office information

TaxSlayer

homepage with access to Pro Online

using the online software

search the knowledge base

“will keep you up to date with any changes and notifications regarding IRS Preparers and Standards in creating/modifying returns for the IRS”

VITA Program

Working Family Tax Credit

Washington Department of Revenue

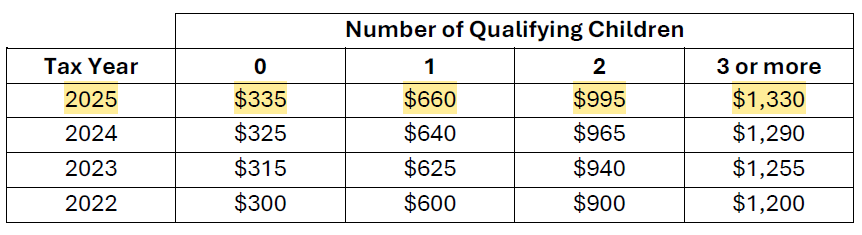

Yearly WFTC Refund Amounts

Each tax year, if you are eligible to receive the WFTC refund, you may receive up to these amounts based on the number of qualifying children you have:

Source: Working Families Tax Credit – Annual Updates ETA 3240.2026 https://taxpedia.dor.wa.gov/documents/current%20eta/3240.2026.pdf

Working Family Tax Credit

About the program

Eligibility (general, residency, and income)

How to apply

Filing with an Individual Taxpayer Identification Number (ITIN)

Refund (status, issues, support)

Working Families Tax Credit – Annual Updates

for all years provides: refund amounts; minimum refund; filing due dates; and the refund phase out percentages.

find local assistance, flyers, etc.

Oregon

Oregon Department of Revenue Website

Forms and publications library

Form: Form OR-40-N, Oregon Individual Income Tax Return for Nonresidents

Instructions: Form OR-40-N and Form OR-40-P, Oregon Individual Income Tax Return for Nonresident / Part-year Resident Instructions

Numeric Codes for Oregon Adjustments, Additions, Subtractions, Modifications, and Credits

In the Individuals section select What’s My Kicker?

Available in kicker years. Odd number years (2025, 2023, 2021, etc.)

In the Individuals section select Where’s My Refund?

Tax Professionals and Practitioners Assistance

Phone: 503-947-3541

Email: prac.revenue@dor.oregon.gov

Phone lines are open 8 a.m. to noon and 1 to 5 p.m. Monday-Friday, closed on holidays. Phone lines are closed from 9 to 11 a.m. Thursdays only.

OR Nonresident - Oregon Source Income

Oregon taxes income that was earned while working in Oregon. Income earned while working elsewhere (Washington) is not taxable.

“Nonresidents—enter the amount you earned while working in Oregon for each job. If that amount differs from the Oregon wages on your Form W-2, request a signed statement from your employer verifying the number of days worked in Oregon and the total number of days worked everywhere. Keep this document and a statement explaining your calculations with your records. If your Oregon wages aren’t stated separately on your Form W-2, compute your Oregon-source income using the following formula:”

(Days actually worked in Oregon / Days actually worked everywhere)

×

Total wages (line 7F)

=

Oregon wages (line 7S)

See OR-40-N instructions page 14

In Taxslayer:

In the Oregon return, select Subtractions from Income.

Select Other Subtraction #1

Enter the amount not taxable in Oregon in “Enter Other Subtractions Amount to be included in Oregon”.

Select Continue

Add a note to the return with the formula and results.

OR Nonresident - Unemployment Compensation

To determine the taxable amount:

Use the Oregon wages as a percentage of total wages reported on his nonresident tax return for the prior year to determine the percentage of unemployment benefits to be included in Oregon income for the current year.

Oregon prior year wages — divided by — Total prior year wages x Total current year unemployment compensation = Oregon unemployment compensation

Source: Oregon Department of Revenue Rule 150-316-0165 Gross Income of Nonresidents; Personal Services > Example 6: Gary, a nonresident, worked in Oregon and Washington for the last 5 years.

Oregon What’s My Kicker Calculator

In the Individuals section select: What’s My Kicker

The kicker is in odd number years, e.g. 2025, 2023, etc.

The kicker on your 2025 personal income tax return will be 9.863 percent of your 2024 tax liability.

TaxSlayer: Oregon Return > Credits > Refundable Credits > Surplus Credit (Kicker)

If the taxpayer has a copy of their prior year OR return, enter the Tax Before Credits.

If the taxpayer does not have their prior year OR return do the following:

Go to the credit in TaxSlayer and scroll to the bottom of the page.

Look up the kicker amount and enter it.